Short Term Disability Information

Disclosures and General Exclusions

Exclusions and Limitations

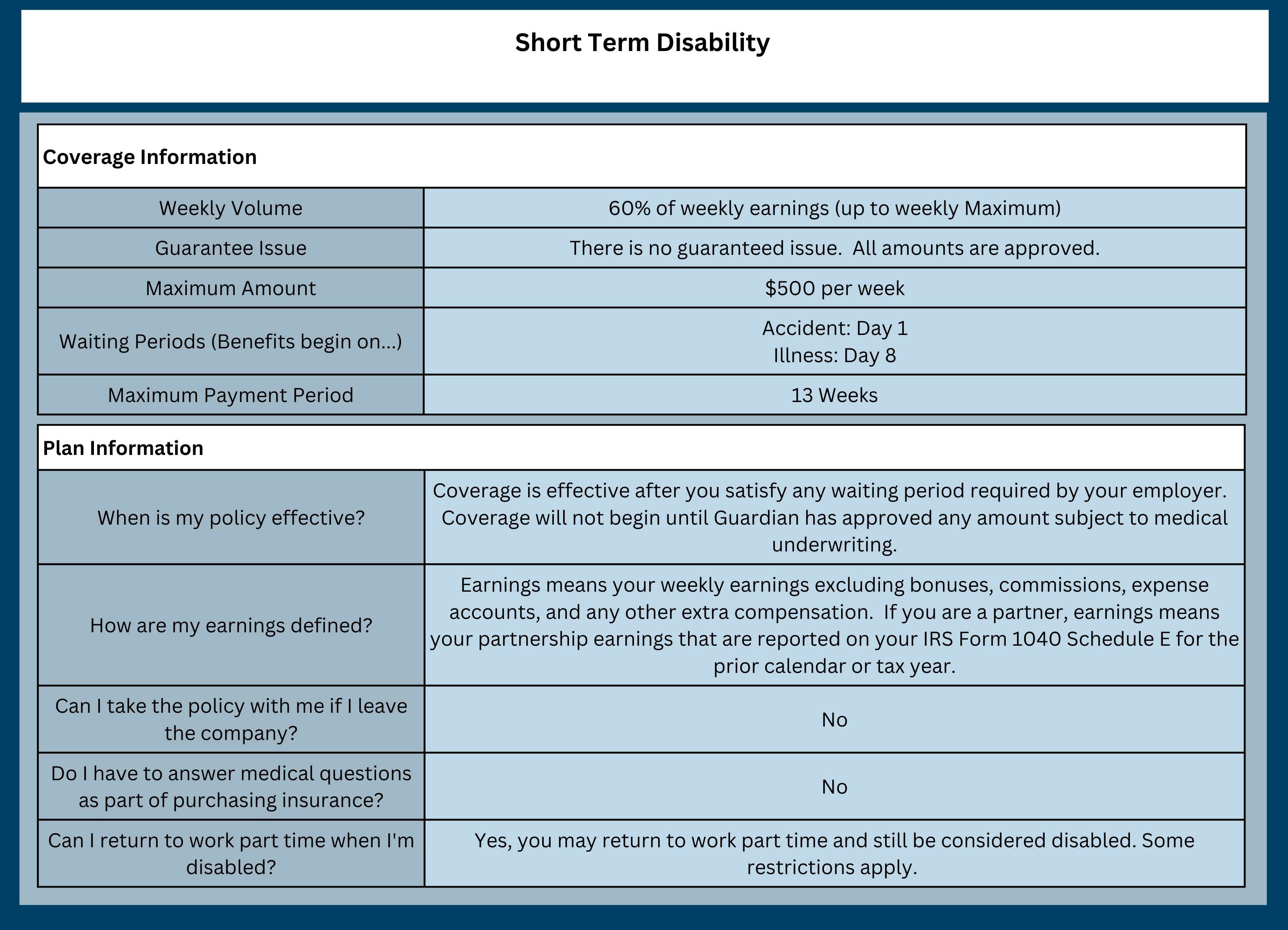

Evidence of lnsurability (EOI) may be required on all late enrollees. This coverage will not be effective until approved by a Guardian underwriter. This proposal is hedged subject to satisfactory financial evaluation. Please refer to certificate of coverage for full plan description. View the Full Summary Plan Description here.

You must be working full-time on the effective date of your coverage; otherwise, your coverage becomes effective after you have completed a specific waiting period.

Employees must be legally working in the United States to be eligible for coverage. Underwriting must approve coverage for employees on temporary assignment (a) exceeding one year; or (b) in an area under travel warning by the US Department of State. Subject to state specific variations.

Benefits for a disability caused or contributed to by a pre-existing condition are limited, unless the disability starts after you have been insured under this plan for a specified period of time. We do not pay short term disability benefits for any job-related or on-the-job injury, or conditions for which Workers' Compensation benefits are payable.

The plan does not pay benefits for charges relating to a covered person:

- Taking part in any war or act of war (including service in the armed forces)

- Committing a felony or taking part in any riot or other civil disorder

- Intentionally injuring themselves or attempting suicide while sane or insane.

- Charges relating to legal intoxication, including but not limited to the operation of a motor vehicle.

- Voluntary use of any poison, chemical, prescription or non-prescription drug or controlled substance unless it has been prescribed by a doctor and is used as prescribed.

- Any period in which a covered person is confined to a correctional facility.

- Not under the care of a doctor

- Receiving treatment outside of the US or Canada.

- The employee's loss of earnings is not solely due to disability.

This policy provides disability income insurance only. It does not provide "basic hospital", "basic medical", or "medical" insurance as defined by the New York State Insurance Department.

If this plan is transferred from another insurance carrier, the time an insured is covered under that plan will count toward satisfying Guardian's pre-existing condition limitation period. State variations may apply.

When applicable, this coverage will integrate with NJ TDB, NY DBL, CA SDI, RI TDI, Hawaii TDI and Puerto Rico DBA, DC PFML and WA PFML.